Asset allocation refers to distributing or allocating money across multiple asset classes, such as equity, fixed income, debt, cash, and others. The primary purpose of asset allocation is to reduce the risk associated with investments. The Board of Trustees receives an Asset Allocation review from APERS staff and the Board’s external investment consultant on a quarterly basis. The review provides data to help determine the fund’s level of risk and volatility as well as the expected return and the expected risk profile based on capital market assumptions. The Board may make any adjustments to the fund’s allocation they deem necessary at any point.

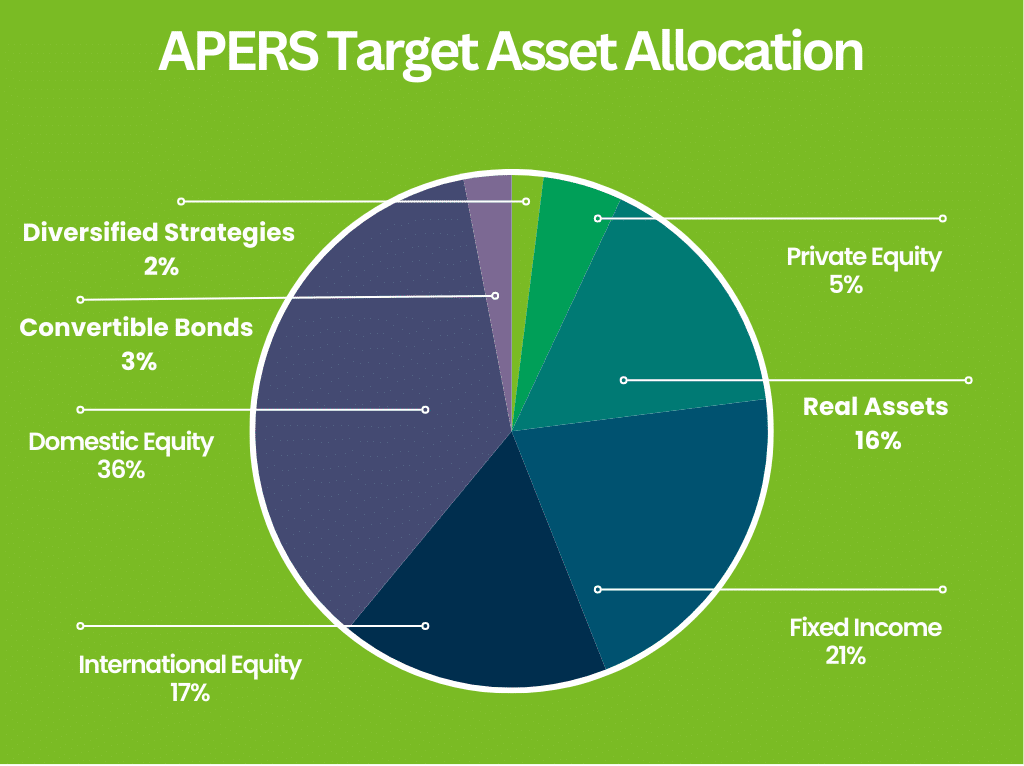

The APERS Board of Trustees has adopted an Investment Policy Statement. This policy establishes the investment objectives of APERS and the investment policies to be followed in carrying out those objectives. The Board has established a target asset allocation as part of this policy.